September 30, 2010

China Relaxes Rules on Gold Imports

According to Reuters, the World Gold Council says China's central bank announced rules in August that will allow Chinese more banks to import and export directly on the global market. As China is slowly building its central bank holding of gold this means that China may soon play an important role in the global trade for bullion....

Labels: banking, currencies, financial news, gold

# posted by Sinomania! : 9/30/2010 04:18:00 PM

0 Comments

Chongqing New Energy Firm to List on NYSE

A polysilicon manufacturer out of Chongqing, Daqo New Energy Corp., looks to rai$e $108 million (US dollars) with a

listing on NYSE under stock symbol

DQ. Daqo makes the key ingredient for solar photovoltaic panels and Daqo lists Yingli Green Energy of Beijing as a major customer. The company began direct manufacturing of solar panels in May when it opened a factory in Nanjing, Jiangsu Province. Daqo New Energy is one of 23 subsidiaries of the Daqo Group, a big electronics conglomerate founded in 1965 in Jiangsu....

Labels: alternative energy, chinese stocks, clean tech, green energy

# posted by Sinomania! : 9/30/2010 03:59:00 PM

1 Comments

September 29, 2010

TRADE WAR: US POLS WANT GREAT DEPRESSION II

According to Reuters the US House of Representatives is poised to approve a bill to impose exorbitant tariffs on Chinese goods by declaring that the Chinese government "subsidizes" the exchange rate of the Yuan. Frustrated by the Executive Branch's longstanding refusal to declare Beijing a currency "manipulator" a corrupt bipartisan House is pandering to big unions, anti-China blowhards, and the widespread ignorance of the vast majority of Americans about America's deep interconnectedness with China.

But will the Senate approve and President Obama sign the legislation and risk a trade war, huge inflation - increases in tariffs would be passed directly to consumers, currency retaliations around the world, and another Great Depression?

Labels: currencies, yuan

# posted by Sinomania! : 9/29/2010 09:13:00 AM

1 Comments

September 28, 2010

China Buys a Slice of Hollywood

Orange Sky Golden Harvest Entertainment Holdings, the year old merger of famed Hong Kong movie studio Golden Harvest and Orange Sky Holdings of Beijing, will buy a 3.3% stake of Legendary Pictures of Burbank, California.

Legendary will get $25 million and the Chinese will get to appoint a Board member. Legendary Pictures has a "strategic partnership" with famous American movie studio Warner Brothers and co-produced this year's summer smash "Inception" and previous hits such as "The Dark Knight."

The two companies will work on Chinese language films, online games, and film distribution in China. American movies are hugely popular in China and last year's WTO ruling may help pry open the door to a big market for a uniquely American product....

Labels: foreign investment, free trade

# posted by Sinomania! : 9/28/2010 04:41:00 PM

0 Comments

Ford to Build New Auto Plant in Chongqing

Labels: automobiles, chinese autos

# posted by Sinomania! : 9/28/2010 12:20:00 PM

0 Comments

Chongqing's 20 Billion Yuan Airport

Labels: aerospace, investment

# posted by Sinomania! : 9/28/2010 12:11:00 PM

0 Comments

September 24, 2010

Will China Takeover Gwadar Port?

According to Reuters Pakistan admiral Noman Bashir, head of Pakistan's Navy, told reporters at a televised news briefing that Pakistan should review the multi-decade contract for Gwadar Port's operations awarded to state-owned PSA International of Singapore. The report says Pakistan is frustrated that the port is largely unused but makes no mention of Gwadar's security problem. Between nativist demands that the port be handed over to Baluchistan tribal leaders, attacks from insurgents perhaps backed by India or even the USA, and the withdrawal of Chinese investment cash it is not a surprise that Gwadar has failed to take off as a new Karachi. If China is put in direct control of the port expect plenty of opposition from Indian and American interests....

Labels: foreign investment, foreign relations, pakistan, shipping

# posted by Sinomania! : 9/24/2010 04:34:00 PM

1 Comments

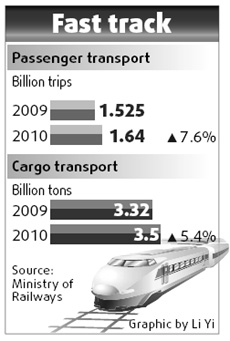

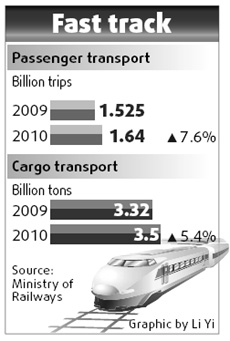

Guangzhou-Chongqing High Speed Rail Route Set

The new Guangzhou to Chongqing high speed railway will run through Nanning, capital of Guanxi Zhuang Autonomous Region, and Guiyang, capital of Guizhou Province

according to Radio China International. Already under construction is the Guangzhou-Nanning-Guiyang section. The Guiyang-Chongqing section will be a challenge as it must tunnel through the Guizhou Plateau but that stretch is scheduled to be completed by 2015! When complete passengers will travel from Guangzhou to Chongqing in only 6 hours versus over 20 hours currently. The high speed rail link will serve as a huge catalyst for spurring the development of the southwest and dispersing overcapacity in Guangdong Province...

Labels: investment

# posted by Sinomania! : 9/24/2010 03:58:00 PM

1 Comments

Russia Says ESPO Price Stays

With the ESPO and new Turkmenistan via Uzbekistan pipelines already open and the Myanmar(Burma) to Kunming and eventually Chongqing underway as well as crude lines potentially running through Pakistan, China is securing oil and gas deliveries free of the Straits of Malacca and more importantly the prying eyes of the US Navy off China's long and vulnerable coastline....

Labels: energy security, oil, pipeline, russia

# posted by Sinomania! : 9/24/2010 03:46:00 PM

0 Comments

September 23, 2010

Obama's National Export Initiative & China

With no fanfare from the White House and zero interest from mainstream media President Obama received a week ago the report (as required by Obama's March 11 Executive Order) from the Executive branch's Trade Promotion Coordinating Committee on the National Export Initiative (NEI).

Although mostly focused on policy and the creation of what promises to be another cumbersome interdepartmental and interagency bureaucracy

the report does single out China as a major focus for US exports. China is the fastest growing market for American exports for many years now.

The NEI report emphasizes six fairly broad areas of focus for China trade: Green Tech including all aspects of 'green' energy and retrofitting, healthcare (medical equipment is already a major export), transport (think railways including urban transit), tourism (very underdeveloped), agriculture (China is already the USA's second biggest export market valued around $13 billion (US dollars) in '09), and lastly education.

The report mentions the importance of Chinese accession to the WTO Government Procurement Agreement but fails to make it a policy objective. Access to China's government procurement was a requirement for WTO acceptance and so far Beijing has kicked the ball for almost a decade. Most of the investment in China's enormous infrastructure and building boom is state-led via direct Central and Provincial government spending. The USA should focus on opening this market by demanding China adhere to the WTO Government Procurement Agreement versus wasting time on political posturing over the exchange rate of the Yuan.

Labels: chinese trade, free trade, goverment procurement, wto

# posted by Sinomania! : 9/23/2010 02:48:00 PM

0 Comments

September 22, 2010

China Has No Property Tax

The rumour mill is running full speed in China with the

latest report by a Chinese newspaper called China Business News that Beijing will implement a property tax at the beginning of 2011 according to a highly-placed anonymous mandarin. Currently China has no property tax a fact that might startle many Americans who continue to view China as as a heavy handed "communist" country. Where the property boom is hottest in cities such as Shanghai and Chongqing property tax proposals have been put forth and some trials are in place. To date however there is no official word on any property tax. Beijing continues to dampen property prices with restrictions on second and third homes and onerous down payment requirements....

Labels: china property, private property

# posted by Sinomania! : 9/22/2010 04:41:00 PM

0 Comments

China to Invest over $1 billion in Ghana Mining

September 20, 2010

China to Build Car Plants in Philippines

Chinese vehicle makers

JAC Motors, Chongqing Astronautic Bashan, and Great Wall Motors Company are planning separate investments in the Philippines to build assembly plants for Chinese trucks and passenger cars. JAC Motors based in Anhui has been exporting vehicles since 1990 and is China's number 1 exporter of light trucks. JAC has an extensive dealership network around the world but so far is kept out of first world markets. This year may be a record for car sales in the Philippines where local production is dominated by Japanese carmakers particularly Toyota. Chinese firms are hoping to carve out market share despite the Philippines's relatively high labor costs and notoriously fickle energy grid...

Labels: chinese autos, exports, foreign investment, foreign trade

# posted by Sinomania! : 9/20/2010 05:01:00 PM

0 Comments

September 17, 2010

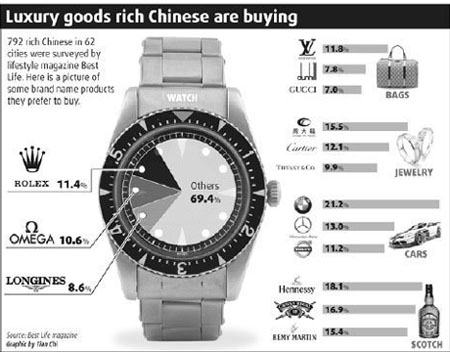

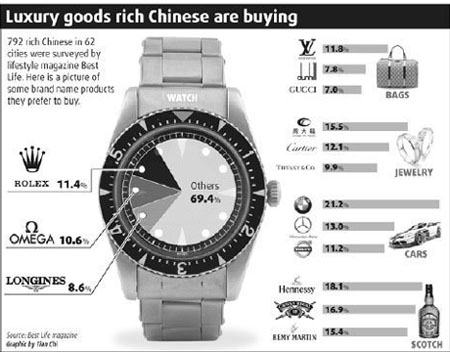

Swiss Watchmaker Sees No Limit to Luxury Sales in China

Labels: foreign investment, foreign trade

# posted by Sinomania! : 9/17/2010 12:06:00 PM

1 Comments

Shanghai Back Below 2,600

The Shanghai Composite, China's bell-weather stock index, is back below 2,600 after a hefty

sell-off at the end of the week. Commenters variously credit rising real estate values and tightening lending standards (for 2nd and 3rd homes only) or the tension with US Treasury Department over currency as the cause for the drop. However, as I have pointed out before the impact of China's week-long national holidays may be at play. At Chinese New Year there is what I call a "hong bao" or "lai see" effect - that is selling stocks for cash gifts. The week-long National Day holiday is coming up soon and the sell-off could be in preparation for the holiday. National Day holiday is also a big occasion to travel, visit family, shop, and party....

Labels: chinese stocks, shanghai composite

# posted by Sinomania! : 9/17/2010 11:45:00 AM

0 Comments

September 16, 2010

TRADE WAR: USA Takes Steel, Credit Card Disputes to WTO

US Trade Rep Ron Kirk is taking two cases against China to the WTO. The first is a tit-for-tat move to impose anti-dumping and countervailing duties on imports of Chinese grain-oriented flat-rolled electrical steel or GOES. The case is on behalf of complaints by AK Steel and Allegheny Ludlum. AK Steel Holding is a private steel conglomerate that has seven plants in politically sensitive Ohio, Indiana, Kentucky, and Pennsylvania, and employs 4,900 members of Richard Trumka's AFL-CIO union.

AK Steel complained in SEC filings that it was negatively impacted by Chinese duties on its GOES sales.

The second case demands access for US credit card giants to China's online processing or electronic financial services.

The suit claims that China agreed to such access in 2006 although it is unclear as the China Trade Relations Act and the WTO accession agreement do not include the services...

Labels: chinese trade, exports, free trade, steel, wto

# posted by Sinomania! : 9/16/2010 11:57:00 AM

0 Comments

September 15, 2010

CURRENCY MANIPULATORS

Twenty-five years ago the USA forced Japan to appreciate its currency in order to correct its own bad books by fixing (temporarily) America's current account deficit. The Plaza Accord of 1985 led to rampant speculation in the Yen and a financial crisis and depression from which the Japanese have yet to recover. From the sidelines, having secured the return of Hong Kong and its capital, Beijing watched and learned.

Since the dotcom bubble popped and jobless recoveries, booms, and busts have America stalled, certain political factions believe that if Uncle Sam can force a similar appreciation of the Yuan on Beijing the American Dream can be saved. Chief among the politicians is Chuck Schumer (D-NY) and his chorus of taxpayer funded think tank reports and leading talking heads. One of the biggest proponents of the China tariff clique is Nobel Prize winning economist Paul Krugman.

Krugman used his NY Times column again today to call for tariffs on Chinese goods deciding that one lesson from the Great Depression - the Smoot-Hawley Act - is not worth heeding.

I've written many posts and Sinomania! Show episodes on the futility of trying to force Beijing's hand on Yuan. Do a search here and on the Sinomania! website and you'll come up with the same conclusion. America cannot fix its problems by manipulating international forex markets. Beijing unlike Japan is not America's satellite and cannot be told what to do and is not afraid of Washington. And the biggest reason why people like Krugman and Schumer know that the issue is just hot air is not the "threat" of a "nuke option" - Beijing selling its holdings of US Treasury securities - but because the average American mired in a deep recession can't afford to pay two and three times for all the stuff they buy from WalMart, Target, IKEA, and everywhere else!

Labels: currencies, financial crisis, forex, free trade, japan, schumer, yuan

# posted by Sinomania! : 9/15/2010 02:23:00 PM

1 Comments

September 14, 2010

Summer Davos 2010 Underway in Tianjin

Lawson to Open Nearly 100 Stores in Chongqing

Japan's second biggest convenience store operator

Lawson plans to open another 130 stores in China by end 2011 - 97 of them in Chongqing alone (the remainder in Shanghai). Lawson is a poster child of multinationalism starting as an outlet for an Ohio dairy farmer, being known for decades as Dairy Mart, Circle K, and owned by American, Canadian, and Japanese conglomerates.

Lawson is making a big push into Chongqing municipality -- China's fastest growing big urban market...

Labels: foreign investment, foreign trade, japan, spending

# posted by Sinomania! : 9/14/2010 02:40:00 PM

0 Comments

September 13, 2010

Chinese Communist Party Africa Tour

A

Chinese Communist Party (CPC) delegation will visit three African countries this week to attend party conferences first in Ethiopia then Malawi and South Africa. The delegation is led by Zhang Xuan, the deputy secretary of the Chongqing Municipal CPC Committee. Ms. Zhang is also an alternate member of the 17th Party Congress on the national level. Zhang is active with the Communist Youth League and could be a rising female star in the party. The tour is at the invitation of political parties in all three countries including the African National Congress. Whether the delegation includes any deal-making is unknown....

Labels: africa, politics

# posted by Sinomania! : 9/13/2010 04:44:00 PM

2 Comments

ReUnification Watch: ECFA Goes Into Effect

The Beijing-Taipei

Economic Cooperation Framework Agreement (ECFA) went into effect Sunday and will lower tariffs on 539 Taiwan originating products and 267 mainland Chinese products and open financial and other economic sectors to investors on both sides of the Straits of Taiwan. Already (official) cross straits trade exceeds $100 billion (US dollars). Expect that sum to expand greatly over the medium term....

Labels: chinese trade, free trade, reunification, taiwan

# posted by Sinomania! : 9/13/2010 04:37:00 PM

0 Comments

September 10, 2010

EU Helps Small Business Into Chinese Market

The

European Union's China Advisory Council recommends that the many business centers established by EU member nations in China be consolidated into "European Houses" to coordinate efforts to get small and medium sized EU enterprises (SMEs) into China. The EU Small Business Act is pushing an effort to help European SMEs into global markets particulary the biggest outside the EU, the USA and China. Overall the EU is expending a lot of effort and financing behind the effort. Why isn't the USA doing something similar? The

US Commercial Service with its small network of offices in China and bloated Washington-centered bureaucracy seems lackluster by comparison...

Labels: chinese trade, foreign exchange, foreign trade, free trade

# posted by Sinomania! : 9/10/2010 04:25:00 PM

0 Comments

China to Add 3 Million Barrels/Day Oil Refining Capacity

China National Petroleum Corp., the parent of PetroChina (NYSE:

PTR) aims to complete a 200,000 barrels per day capacity oil refinery in Kunming by 2013. The refinery will process crude delivered by the Burma (Myanmar) to Chongqing pipeline currently under construction. When complete it will give 400,000 barrels per day to feed the growing cities of Yunnan Province and in particular independent megalopolis Chongqing. A gas pipeline is also under construction through Burma to Yunnan with terminus in Guangxi Zhuang Autonomous Region that will deliver 12 billion cubic meters of gas. Completion dates for the pipelines are not known at this time but all told

China plans to finish refining capacity for an additional 3 million barrels per day in the next 5 years....

Labels: asian energy security grid, energy security, gas, oil, peak oil

# posted by Sinomania! : 9/10/2010 04:15:00 PM

0 Comments

September 09, 2010

What Happened to the China Collapse Call?

Stephen Green of Standard Chartered Bank (Shanghai), an expert in China's stock markets,

writes in Bloomberg that China is returning to a "Sweet Spot" for foreign investment as the Chinese economy is neither too hot nor too cold. China may see an influx of $100 billion (US dollars) in FDI this year.

Morgan Stanley's Chief Economist for China Qing Wang (he replaced Andy Xie) calls it the "Goldilocks Scenario" and has advised for some time that Beijing's mandarins are skilled at using the right policy tools at the right time and have succeeded so far in avoiding hyperinflation and any crash including it appears a property bubble.

If China is Goldilocks what about the Bears that said China was too hot/cold and ready to crash? Mark Faber, Jim Chanos, and others may have some explaining to do if China doesn't disintegrate soon...

Labels: chinese stocks, economy, financial news, morgan stanley

# posted by Sinomania! : 9/09/2010 04:22:00 PM

1 Comments

CHINA SIGNALS WTO GPA MOVE

Vice President Xi Jinping responded to criticism of "buy China" bias in Chinese government procurement and China's near decade long foot-dragging on agreeing to the Word Trade Organization's Goverment Procurement Agreement (GPA) - a requirement of China's WTO accession protocol - telling reporters in Beijing that "with regard to government purchases and construction projects, the Chinese government will adopt an open, transparent plan to let foreign companies and technological products enjoy equal treatment."

In October it is believed Beijing will restart talks toward China signing the WTO GPA. Regular readers know this is a hugely important negotiation to watch. If the USA and EU can compel China to own up to its WTO commitments regarding government procurement it could potentially open the biggest market of all for exports to China. The possibility of competing for Chinese infrastructure and technology projects could help give President Obama's neglected "National Export Initiative" a chance for success...

Labels: foreign relations, free trade, goverment procurement, wto

# posted by Sinomania! : 9/09/2010 04:11:00 PM

0 Comments

ReUnification Watch: First Mainland Firm Lists on Taiwan Exchange

Yangzijiang Shipbuilding (registered in Singapore but with all operations on China mainland)

surged 7% today when it opened on the Taiwan Stock Exchange. The interest in shares shows that the long list of mainland firms eyeing a Taiwan listing may reap rich awards when listing becomes easier and directly possible as China and Taiwan merge their already closely related economies...

Labels: chinese stocks, reunification, shipping, taiwan

# posted by Sinomania! : 9/09/2010 04:05:00 PM

0 Comments

1st Shipment Leaves ChonqQing Cuntan Bonded Port

The new Cuntan Bonded Port in Chongqing - China's only inland special port custom district -

cleared its first shipment in a matter of days signalling the start of an increase in direct trade from the city. The Cuntan Bonded Port is an important development for Chongqing's economy. You can read my earlier posts on it here at the Sinomania! blog.

Click here for some information about bonded ports in China....

Labels: chinese trade, foreign trade, free trade, shipping

# posted by Sinomania! : 9/09/2010 03:45:00 PM

1 Comments

Deutsche Bank Enters ChongQing

Labels: banking, financial news, globalization

# posted by Sinomania! : 9/09/2010 03:35:00 PM

0 Comments

Chinese Auto Sales Over 1 Million in August

Retail passenger car sales in China soared almost 60% over last year in August. Year-to-date the top auto sellers are the SAIC group (including Shanghai GM now run directly from Shanghai); GM; Dongfeng Motor; Toyota; and Honda.

Ford Motor ranks number 6 but is growing fast including a brand new partnership with Chongqing Changan Auto to build cars for export outside China.

In other auto news Chongqing Changan Auto's joint venture with Peugeot will invest billion$ to produce Citroen's top DS line of small cars and create a new brand for the company....

Labels: automobiles, chinese autos, gm

# posted by Sinomania! : 9/09/2010 03:20:00 PM

0 Comments

China Stock Market Cap Tops USA by 2030

According to a new report by Goldman Sachs (

via the Financial Times) emerging markets stock market capitalization will reach $80 trillion (US dollars) by 2030 from around $14 trillion today with China the world's largest stock market cap by a wide margin....

Labels: chinese stocks, global economy, stock market

# posted by Sinomania! : 9/09/2010 03:05:00 PM

2 Comments

Subscribe to Posts [Atom]