February 28, 2010

I do not think we should play compromise any longer.

"We should refuse to recognize Rumania and Bulgaria until they comply with or requirements; we should let our position on Iran be known in no uncertain terms and we should continue to insist on the internationalization of the Kiel Canal, the Rhine-Danube waterway and the Black Sea Straits and we should maintain complete control of Japan and the Pacific. We should rehabilitate China and create a strong central government there. We should do the same for Korea.

Then we should insist on the return of our ships from Russia and force a settlement of the Lend-Lease Debt of Russia.

I'm tired of babying the Soviets."

Source: An unsent letter by President S Truman to Secretary of State James F. Byrnes dated January 5, 1946 -- Harry S Truman Library, Harry S Truman Papers, President's Secretary's Files , Box 333, 1946.

Labels: Sinomania

Daily Posting

At the late dawn of the Internet age in 1998 Sinomania! heard a piece of advice that was not heeded. The success of any website ("blog" did not exist then) is based on regular posting every day at a minimum.

In keeping with this spirit on days when Sinomania! is unable to post meaningfully a random quotation relevant to China is offered.

February 25, 2010

Anti-China Senators Call For "Crackdown" On China

Longstanding China critic Senator Chuck Schumer of New York is leading a pack of anti-China Senators in election year pandering to big union and other contributer interests by urging the Obama administration to -once again- declare that Beijing is "manipulating" its currency and solely responsible for the loss of American manufacturing jobs.

The anti-China coalition consists of:

- Charles E. Schumer (D-NY)

- Lindsey Graham (R-SC)

- Robert Byrd (D-WV)

- Carl Levin (D-MI)

- Barbara Mikulski (D-MD)

- Russ Feingold (D-WI)

- Susan Collins (R-ME)

- Olympia Snowe (R-ME)

- Sam Brownback (R-KS)

- Jim Bunning (R-KY)

- Debbie Stabenow (D-MI)

- Ben Cardin (D-MD)

- Sherrod Brown (D-OH)

- Bob Casey (D-PA)

- Arlen Specter (D-PA)

Anyone familiar with these politicians knows that they are the chorus in all condemnations against China. Sherrod Brown is a bomb thrower of particular reknown being a co-founder of the Taiwan Congressional Caucus.

The hypocrisy in the Senators' action is rich. All are beholden to special interests that require them to play a China card on wedge issues such as trade and human rights. Yet many come from states that benefit greatly from expanding Chinese trade, the USA's third biggest and fastest growing export market. It is afer all US multinational corporations that lead the charge in outsourcing to China. And there is no matching call against the Japanese Yen which is actively supported by Tokyo to be just as advantageous in trade.

Election year politics aside regular readers know that Washington is powerless to force currency appreciation on China beyond what is already happening in the markets....

Labels: china policy, chinese trade, congress, currencies, free trade, hypocrisy, schumer

February 18, 2010

China Doomsayers

Labels: chinese stocks, economy, global economy, markets, stock market

The Deceiver of Dharamsala

Labels: dalai lama, free tibet, hypocrisy

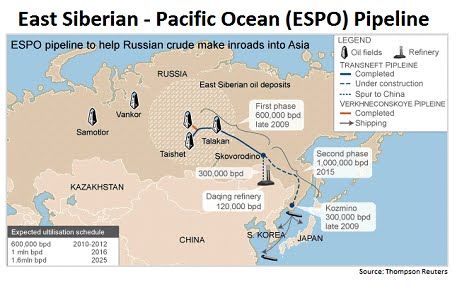

China Buys ESPO Crude

Labels: foreign trade, oil, peak oil, pipeline, russia

February 16, 2010

China Gives WoW New Life

Labels: games, tech stocks

February 13, 2010

Xin Nian Kuai Le! Happy New Year! Gung Hay Fat Choy!

Happy New Year wishes from Sinomania! 2010 is the Year of the Tiger and year 4,707 of the Chinese calendar, one of the oldest and longest running in world history.

Chinese New Year (still officially called "Spring Festival" by the Chinese government) is the most important family holiday of the year. As in the USA during Thanksgiving, Chinese travel across the country to reunite with family. Next week is a week long national holiday in China known as a "golden" week. Retail sales usually skyrocket during this period and huge amounts of money exchange hands as family give lai see or hong bao (red envelopes filled with crisp paper money)...,

Labels: new year

February 12, 2010

World Markets Slide: Blame China

More likely world markets reacted to news from the EU that its anemic recovery is faltering. Official statistics from the EU show that 4th Quarter 2009 GDP barely increased 0.1% and industrial production fell almost -2%. Add the ongoing sovereign debt problems in Greece and other EU members and surely world markets are more rattled by events in the EU than anything happening in China.....

Labels: banking, financial crisis, global economy, stock market

February 11, 2010

Changan Auto Expands Into EV Production

Labels: batteries, chinese autos, electric cars, foreign trade

Major Gas Find in South China Sea

Labels: energy security, gas, hong kong, oil, peak oil

February 10, 2010

Fox News Part Owned by Red China

There are 2.62 billion shares outstanding of Rupert Murdoch's New York City based News Corp., the parent of "The Most Powerful Name in News" Fox News Channel. Of those shares 300,000 valued at over $4 million (US dollars) are owned by the China Investment Corporation - the sovereign wealth fund (SWF) of the People's Republic of China. The holdings of News Corp. represent the only media investment by Communist China.

In perspective China owns only a small piece of News Corp. But the shares are Class A which have special rights. And often the purchase of Class A shares implies that more shares are anticipated as the initial upfront investment declines with additional investment.

The bigger question though is do conflicts of interest exist between Rupert Murdoch's desire to build business in China, Beijing's investment in his company, and the reporting of Fox News?....

Labels: business news, foreign investment, foreign relations, media

Reunification Watch: Taiwan to Allow Mainland Investment in Financial Sector

Labels: financial news, reunification, taiwan

West China Opens High Speed Rail

Labels: economic impact, high-tech, investment

February 09, 2010

China's Portfolio: AAPL BLK KO NWSA RIMM TCK V

CIC's Major holdings of Morgan Stanley (MS) and Blackrock (BLK) are well known but less known are sizeable share blocks in healthcare and pharmaceuticals including Health Net, Abbott Labs, Pfizer, Merck, Eli Lilly, and financials & banks such as Metlife, Bank of America, Citigroup, Comerica, and Wells Fargo.

China owns 30,000 shares of Apple; 158,100 shares of Coca-Cola; 300,000 shares of Rupert Murdoch's News Corp.; 401,100 shares of Sprint; and $350 million worth of Visa, Inc. China also has investments in iShares indexes and SPDR ETFs ranging from $50 million+ to over $200 million per account. The Form 13F and full list of China's portfolio can be viewed at the Sinomania! website here. Chart via CFR.org, Brad Setser....

Labels: foreign investment, foreign relations, forex, stocks

February 08, 2010

Iran Says China Top Trade Partner

Labels: energy security, foreign investment, foreign relations, gas, india, iran, pakistan

Vietnam-Guangxi To Expand Trade Zone

Labels: foreign exchange, foreign relations, free trade

China Overseas Oil Production to Reach 1.2 Million Barrels Per Day

Labels: energy security, foreign trade, imports, oil, peak oil

February 05, 2010

Trade War: China Anti-Dumping Duties on US Chicken

Meanwhile Beijing has filed a dispute settlement with the WTO over the EU anti-dumping tariffs on Chinese made footwear saying the EU never removed quota restrictions on Chinese imports after China acceeded to the WTO....

Labels: chinese trade, foreign relations, foreign trade, free trade

February 04, 2010

Foreign Firms To IPO on Shanghai Exchange

Labels: chinese stocks, foreign investment, stock market, stocks, tech stocks

February 03, 2010

Chinese Explorations Past and Present

Flash forward to today where Chinese explorations of Earth's north and south poles are revealed in a new Atlas of the Artic and Antarctica. Beijing's Chinese Artic and Antarctic Administration guides numerous surveying expeditions. Just now the 26th Chinese Antarctic Expedition (CHINARE) concluded a trip to the south pole....

Labels: foreign relations

February 02, 2010

Time to Settle US Arms Sales to Taiwan

The Taiwan Relations Act does imply if not compel the USA to supply arms to Taiwan for its defense. As Taipei and Beijing rapidly detangle 60+ years of separation with historic cooperation it can be argued just what is Taiwan defending itself against? But the 1982 Sino-American communique says the USA will end arms sales to Taiwan. Specifically,

6. Having in mind the foregoing statements of both sides, the United StatesThe foregoing was agreed to by both sides NEARLY 30 YEARS AGO. The only people benefitting from the latest arms deal are three corporations, perennial Pentagon suppliers Boeing, Lockheed-Martin, and United Technologies. It is time for the USA to stop fanning flames and work toward peace by ending arms sales to Taiwan.

Government states that it does not seek to carry out a long-term policy of arms

sales to Taiwan, that its arms sales to Taiwan will not exceed, either in

qualitative or in quantitative terms, the level of those supplied in recent

years since the establishment of diplomatic relations between the United States

and China, and that it intends to reduce gradually its sales of arms to Taiwan,

leading over a period of time to a final resolution. In so stating, the United

States acknowledges China's consistent position regarding the thorough

settlement of this issue.

7. In order to bring about, over a period of

time, a final settlement of the question of United States arms sales to Taiwan,

which is an issue rooted in history, the two governments will make every effort

to adopt measures and create conditions conducive to the thorough settlement of

this issue.

Labels: foreign relations, military-industrial complex, reunification, taiwan

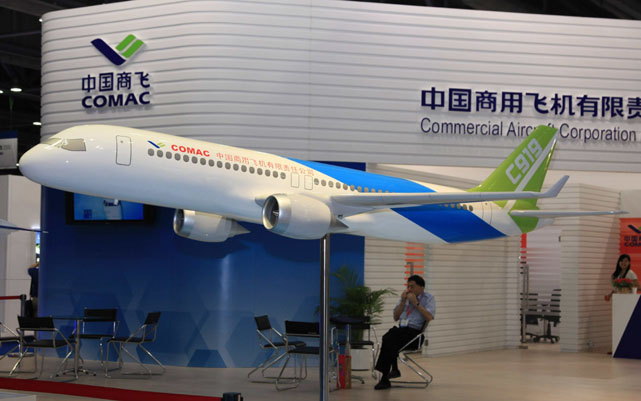

Boeing 737 - Airbus A320 - Comac C919

Labels: aerospace, aircraft, boeing, foreign trade, jet planes

Chinese Researchers Use Acupuncture for Cancer Detection

Labels: high-tech, technology

February 01, 2010

Chinese Investment Returns to Gwadar - Future Overseas Base?

Of course the idea that a Chinese Navy base or two in support of Chinese shipping could alter America's military supremacy is absurd. As the map pictures, China is ringed by US military installations. And all Chinese traffic in the seas around China are at the mercy of US Navy ships, carriers, and submarines. More probably Dr. Shen's editorial is more a salvo in the war of words over Obama's arms sales to Taiwan.....

Labels: chinese trade, foreign relations, global security, military-industrial complex, navy, pakistan

Subscribe to Comments [Atom]