March 27, 2009

US Soy Exports to China Up

Labels: exports, foreign trade

# posted by Sinomania! : 3/27/2009 02:50:00 PM

0 Comments

March 26, 2009

H Shares Hot Again

JP Morgan is "overweight" H shares pointing out that valuations of Chinese majors in Hong Kong are substantially less than their listed shares in Shanghai (most of which - A shares - are not available to non-Chinese). The Hang Seng China Enterprise is up and the combined A&B Shanghai Composite Index is near its year-to-date high. These are signals that the bottom may have been reached - barring a complete global collapse - in Chinese stocks. On to the next bubble....?

Labels: chinese stocks

# posted by Sinomania! : 3/26/2009 10:42:00 AM

0 Comments

March 22, 2009

Ed note: Light posting; Sinomania! on assignment

Sinomania! is back East to our national capital on an important matter...back soon. Meanwhile, keep your eye on the

Shanghai Composite....

Labels: shanghai composite

# posted by Sinomania! : 3/22/2009 11:37:00 PM

1 Comments

March 20, 2009

China to Boost Gold Reserves

The Beijing Ministry of Industry and Information Technology says

consolidation is desired in the gold producing businesses, perhaps as part of the overall "reinvigoration" of China's economic sectors. The goal is add up to 800 tons of gold reserves and increase production further. China surpassed South Africa as the world's biggest gold producer in 2007. Unknown is whether the increased production will be added to China's official gold reserve holdings currently 9th largest in the world although only a small fraction of the gold held by Europe and the USA...

Labels: gold

# posted by Sinomania! : 3/20/2009 12:25:00 PM

0 Comments

March 19, 2009

Snow Dragon Heads Home

Labels: strategic

# posted by Sinomania! : 3/19/2009 05:05:00 PM

0 Comments

March 18, 2009

SOHU CYOU IPO

Labels: games, stocks

# posted by Sinomania! : 3/18/2009 03:20:00 PM

0 Comments

Coca-Cola: Remember Maytag and UNOCAL?

Back in 2005 and 2006 the US Congress stopped the potentially lucrative - to its shareholders - sales of Maytag to Haier and UNOCAL to CNOOC. And both Democratic and Republican members of Congress continue to prevent Chinese companies from buying their American peers such as in the auto industry. It is 'tit for tat' time in USA-China trade once again...

Labels: foreign investment, free trade

# posted by Sinomania! : 3/18/2009 02:24:00 PM

0 Comments

March 17, 2009

Now Marc Faber Says Buy China

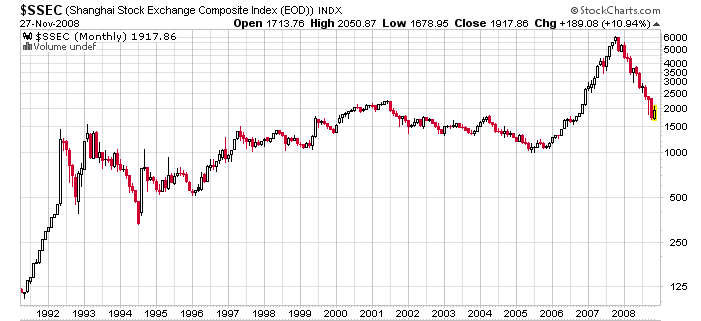

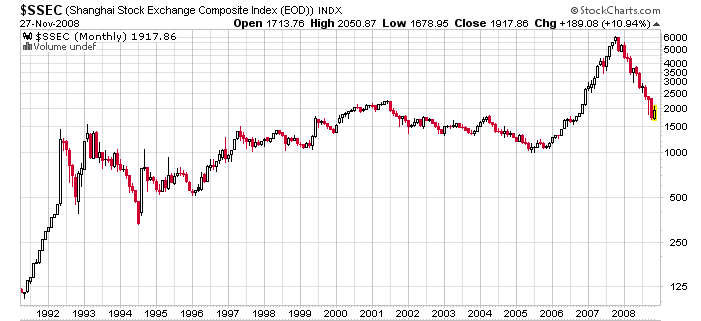

Two years ago legendary investment guru Marc Faber warned of a collapse in Shanghai share prices. If you took his advice you missed the explosion in Chinese stocks that saw the Shanghai Composite Index reach past 6,000 in October 2007. But all 2008 Chinese stocks sank losing nearly 70% of their value - a remarkable bust akin to the Wall Street's collapse in the 1930s but in a much shorter time frame.

From that bottom Shanghai is now the best performing stock market in the world with gains between 15% and 20%.

Now Marc Faber says it's time to buy and hold for the next year or two. Will overseas investors respond? Is it time to look at Chinese stocks again? How about a new season of the Sinomania! Show to examine some of these promising Chinese shares? Let me know what you think, dear readers...

Labels: bear market, chinese stocks

# posted by Sinomania! : 3/17/2009 02:52:00 PM

0 Comments

China Bank Regulator to Allow M&A Financing

The intent is to reduce the problem of excess production capacity in China and thus try to control supply versus demand. Infrastructure spending that could eventually accomodate greater demand will be avoided in favor of "soft" investment in social services (although high speed rail projects appear safe). One of the goals is to remake all major industrial sectors into oligarchies of big globally competitive corporations by shutting down or absorbing backward and smaller producers...

Labels: banking, panic of 2008

# posted by Sinomania! : 3/17/2009 12:01:00 PM

0 Comments

Tianjin Port Consolidates

Labels: foreign trade, shipping

# posted by Sinomania! : 3/17/2009 11:51:00 AM

0 Comments

March 16, 2009

China FDI Flows Reversing

China has been the leading recipient of Foreign Direct Investment (FDI) from other countries since 1992. But FDI in China has declined for the past 5 months and sank nearly 16% in February. Meanwhile

Beijing is loosening controls on outbound Chinse FDI with acquistions under $100 million requiring only local authority approval. At current rates, outbound FDI may soon exceed inbound.

Several big Chinese outside investments are making news including Minmetals desire to acquire OZ Minerals in Australia. Unfortunately for the USA Congressional sinophobia may prevent Chinese investments in ailing American industries. Many analysts expect Chinese investment may focus on resouce commodities and energy...

Labels: foreign investment

# posted by Sinomania! : 3/16/2009 10:05:00 AM

0 Comments

March 13, 2009

The Tibet Uprising That Wasn't

Wednesday past (March 11) was the 50th anniversary of the 1959 uprising in Tibet that brought Chinese troops into Lhasa and led to the flight of the Dalai Lama, his court, and several thousand of his supporters and elites to India. The anniversary was marked by

small demonstrations in European and American cities ranging from one thousand or so in London and New York to a couple dozen in Western capitals such as Canberra and Washington. Tibet was under a Beijing enforced clampdown so we were told by a relentless barrage of media stories during the preceding week.

The question is really why does the West want confrontation over Tibet? At the western end of the vast Tibetan Plateau lies Afghanistan where the USA occupies the land and drops bombs on civilians in the latest effort to bring the people up from the 13th Century to the present. Yet Chinese rationalizations for doing just the same thing - some might argue with a certain degree of success and without aerial bombardment - are roundly criticized as ‘genocide.’ Washington has no plans to vacate the western end of the Tibetan Plateau. In fact, Obama has made a ramp up of American forces there his priority.

The Tibetan Plateau is the largest and highest land area on Earth. That is its strategic value. It would be the only land area above water if the world were to flood as in “End Times” scenarios. The area is the source of seven of the world’s greatest rivers, the water supply for billions. Every military strategist from Sun Tzu to Clausewitz knew the importance of holding the high ground. But the USA and China need to cooperate not confront each other in this region unless the 21st Century be dominated by a new “Great Game” that could destroy both nations.

Labels: dalai lama, free tibet, great power

# posted by Sinomania! : 3/13/2009 04:11:00 PM

0 Comments

TRADE WAR: Obama's 'Imperfect' Bill Includes China Trade Block

Among the earmarks, pork, and other goodies in the 'imperfect' federal spending bill signed into law by President Obama on Wednesday is a restriction on poultry imports from China. US China poultry trade resumed in 2004 after a bird flu (and SARS) outbreak and former Senator Joe Biden of Delaware and Senator Mikulski of Maryland were very active in opening Chinese markets for their states' chickens. But USA imports from China did not restore in other words there was not 'tit-for-tat' the age old balance in China trade.

Now Chinese chicken will be completely restricted according to language in the new spending package. This is flat out protectionism and another dangerous sign that the US Congress - now with Obama's authority - may jeopardize USA-China trade relations.

Beijing has signalled it my begin a WTO dispute in the matter...

Labels: foreign trade, free trade, wto

# posted by Sinomania! : 3/13/2009 11:04:00 AM

0 Comments

March 11, 2009

China Auto Sales Surge

827,600 autos were sold in China in February

almost a 25% increase year-on-year and enough to maintain China as the world's number 1 car market. Meanwhile the USA auto industry suffered its worst month since December 1981 (when the population was 75 millions smaller)...

Labels: automobiles, chinese autos, global economy

# posted by Sinomania! : 3/11/2009 03:42:00 PM

0 Comments

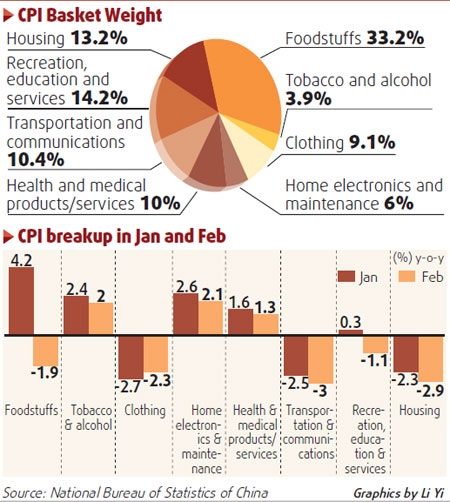

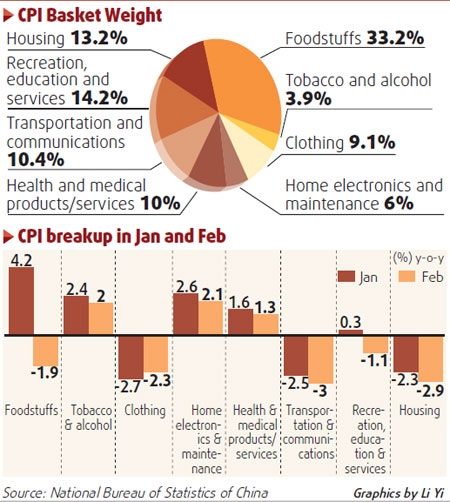

Deflation: Negative CPI First Since 2002 in China

Consumer prices are falling in China with overall CPI down -1.6% the first negative inflation indication since 2002...

Labels: economy, prices

# posted by Sinomania! : 3/11/2009 03:30:00 PM

0 Comments

Charles Freeman Rejection as Much About China as Israel

Charles (Chas) Freeman withdrew his candidacy to head President Obama's National Intelligence Council after intense objections from Congress including entire Democratic Party members of relevant committees. The line is that Freeman was not sufficiently subservient to the Israel lobby. But just as important is his connections with China through his son. Critics questioned his "ties" to China but being on an advisory board of a huge mulitnational company such as CNOOC is hardly a tie. Also at issue were comments made about Tiananmen Square --is American political discourse really this petty?

More significantly, Freeman's son Charles W. Freeman III was assistant US Trade Representative for China trade under President Bush and as such shepherded China into the WTO under the US China Trade Relations Act signed by President Clinton just prior to the 2000 election. Freeman handled a politically charged envirnoment for years with pragmatism and realism and helped W enlarge and improve USA-China relations, perhaps the only positive legacy of President Bush.

There was no way anti-China trade Democrats, chief among them tariff king Charles Schumer (D - NY), could tolerate such world views.

The move to reject Freeman is a direct win for the Pentagon and all its allies who are beating the war drums at Beijing.

So much for "change" in Washington...

Labels: congress, foreign relations, pentagon

# posted by Sinomania! : 3/11/2009 12:04:00 PM

0 Comments

March 10, 2009

Savings Glut: Over $3 Trillion in Chinese Bank Deposits

According to this chart included with the NPC's 2008 statistical communique, total savings deposits in Chinese banks jumped dramatically last year - over 26% - to nearly 22 trillion Yuan or $3,184,800,000,000 (US Dollars) according to today's exchange rate. The propensity to save among Chinese is legendary. Given that the Panic of '08 didn't impact China severely until the 4th Quarter of 2008, savings will only grow further this year. When will spending return and where will it go...

Labels: national peoples congress, panic of 2008

# posted by Sinomania! : 3/10/2009 02:19:00 PM

0 Comments

March 09, 2009

Spy Ship Incident

Here we go again.

Joe Biden warned of an early international crisis for President Obama. Just a few months into his first term as President George Bush had the "spy plane incident" with China ultimately leading to a full

apology from the White House.

This weekend the

US Navy whined that while conducting "routine" (read: intelligence) operations south of Hainan Island (where the spy plane was allowed emergency landing) its ships were "shadowed and aggressively maneuvered in dangerously close proximity" by Chinese flagged vessels (only 1 of the ships apparently Chinese Navy). But who is the agressor here? If Chinese Navy ships began conducting "routine" operations 25 miles off San Diego how would the US Navy react?

The Pentagon needs a bogeyman. The so-called War on Terror is losing relevance to most Americans. Congressman Barney Frank of Massachusetts is pushing for a 25% reduction in military spending. As the US federal government debt balloons to countless trillions some in America are questioning the need to spend at least $1 trillion annually on its war machine.

In 2001 I pointed out the need to get to know China instead of looking for a fight. Sadly, I

reiterate that call again today.

Labels: cold war 2, navy, pentagon, spies, spy, spying

# posted by Sinomania! : 3/09/2009 09:29:00 AM

0 Comments

March 06, 2009

China Central Bank Says Currency Policy "Needs No Changes"

"The question should be raised to some countries where the financial crisis originated from: what's going to happen eventually on your side?" We have to make multiple plans and analyze various scenarios since there is obviously great uncertainty on their side..."

Labels: banking, currencies, panic of 2008, renminbi, yuan

# posted by Sinomania! : 3/06/2009 09:21:00 AM

0 Comments

March 05, 2009

CHINESE CONGRESS CONVENES

The second session of the 11th National People's Congress (NPC) is underway in Beijing and off to a blunt start with PM Wen Jiabao declaring in opening remarks that China faces "

unprecedented difficulties and challenges." To the dismay of some around the world Wen did not announce any specific new stimulus for the Chinese economy straining to maintain growth. In fact, attention is paid to Beijing's budget deficit nearing 1 trillion Yuan, the highest since the earliest days of the People's Republic.

Where is Beijing putting its money? As in the USA, military spending tops the central government budget and will rise this year by nearly 15%. A lot of focus is put as usual on welfare spending and there will be new initiatives for farmers and poor agricultural areas. So far no announcements about land reform - probably the biggest potential development in China and a very important topic to watch.

In an indication of the continuing improvements in relations between Beijing and Taipei PM Wen Jiabao said

Beijing was ready to hold talks on cross-straits political and military issues.

NPC sessions usually last just under 2 weeks and are typically dismissed by foreign press as a "rubber stamp" event. But as I point out each year you ignore the work of the NPC at your peril as it reflects the great airing of grievances of Chinese and reveals important clues as to future direction in the country as well as legislating the policy work of the State Council. You can follow news of the NPC at its

official website.

An interesting twist at the outset is a new seating arrangment in the Great Hall of the People: front row seating will be rotated by an unknown formula allowing delegates from different regions and interest group blocks to sit near the dais and participate more directly in the work of the Congress...

Labels: national peoples congress

# posted by Sinomania! : 3/05/2009 11:08:00 AM

0 Comments

March 04, 2009

SOE Reform - More Consolidation Ahead

World media and trading floors are twittering about whether

China may save the world from a global depression. Reports are Chinese manufacturing is trending up and commodities prices are moving in the same direction in the hopes that Chinese demand will save our future. Adding to the excitement is a flurry of news leaks in the run up to the opening of China's annual parliament, the National People's Congress, March 5 in Beijing.

The biggest tease is that the NPC will approve more stimulus even though 11 separate stimulus packages were announced by Beijing on a regular basis over the past few months.

Labels: global economy, national peoples congress, panic of 2008

# posted by Sinomania! : 3/04/2009 10:12:00 AM

0 Comments

March 03, 2009

Just Say No to Foreign Acquisitions Beijing Tells Car Makers

Labels: chinese autos, foreign investment, free trade

# posted by Sinomania! : 3/03/2009 10:50:00 AM

0 Comments

March 02, 2009

China and Guinea-Bissau: Honeymoon Over?

Labels: foreign relations, strategic

# posted by Sinomania! : 3/02/2009 09:56:00 AM

0 Comments

Subscribe to Comments [Atom]