April 15, 2010

OPEN THREAD

Labels: Sinomania

China Doomsayers Keep Talking

Labels: economic impact, media

April 12, 2010

Trade War: China Imposes Duties on US, Russian Steel

The Chinese Ministry of Commerce has not publicly announced the rulings yet. The investigation was brought by steel majors Baosteel and Wuhan Iron & Steel in June 2009 and focused in particular on incentives and subsidies given by the state of Pennsylvania.

Labels: foreign relations, foreign trade, free trade

China Wants Canada's Oil Sands

Labels: energy security, foreign investment, oil, peak oil

April 09, 2010

China Could Become Oil Exporter Again

In January China National Offshore Oil Corp. (NYSE:CEO) obtained license to export refined oil products. Just a year ago the company opened a new refinery at Huizhou, Guangdong, that is being upgraded to refine up to 22 million tons of oil per year.

If Beijing's big push for alternative energy is successful will all the new refined oil production be needed in China? Or could it end up exported onto Asian or international markets?

Labels: alternative energy, exports, oil, peak oil

Reunification Watch: China-Taiwan Telecom Tie Up

Labels: reunification, taiwan, Telcom

Beijing Ramps Up Heavy Industry Restructuring

The consolidation of China's massive but scattered and often inefficient heavy industrial plant is a long standing goal. It will be accomplished through corporatization of government-owned businesses and mergers and acquisitions leading to a handful of powerful industrial leaders. This is part of Beijing's overarching desire to see American style "big 3" players in all industrial sectors.

Economic restructuring is one of 5 key areas Beijing is channeling central government resources into in a bid to jump start a "third wave" in the Chinese economy. The other areas are agriculture, alternative energy, social services particularly education and health care, and "independent innovation"....

Labels: alternative energy, clean tech, high-tech, investment, reform, steel

April 08, 2010

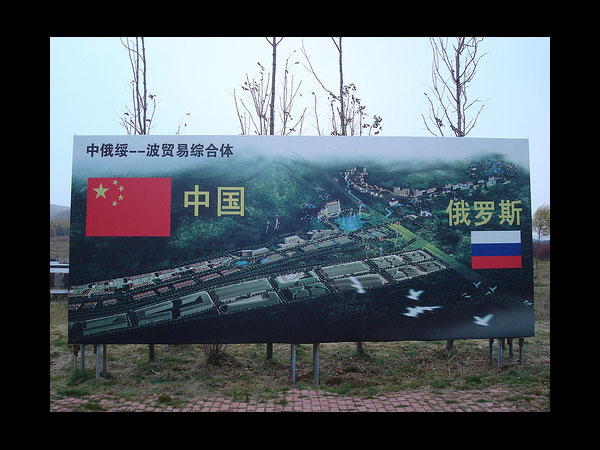

Vladivostok Increases Ties with Heilongjiang

Sinomania! readers will recall that at the provincial level Heilongjiang and Primorsky Krai (Russia's Far East) are spearheading cooperative efforts. Xi Jinping's recent Russia-EU tour began in Vladivostok with a welcome from Russia's top leaders.

Manchuria and Siberia remain underdeveloped and rich in resources. Along with the Tumen River area the region could be a major center of migration, industrialization, and urbanization in the medium to long term....

Labels: cooperation, foreign exchange, foreign relations, russia

China Wants Canada's Nickel

Labels: foreign investment, foreign relations

April 07, 2010

Kyrgyzstan: Who's In Charge?

The "Tulip Revolution" of 2005 failed as Kyrgyz President Kurmanbek Bakiyev preferred his neighbors Russia and China to Uncle Sam. On March 11 the US State Department issued a human rights report against the Kyrgyz Republic creating the background and justification for future intervention. Now the "United Tajik Opposition" or UTO (which was active in Kyrgyzstan's civil war after the Soviet Union collapsed) is disrupting the urban centers of the country.

Coincidentally, just in the last two weeks major investments by Chinese ventures were ramping up in Kyrgyzstan including energy giant China Guodian Corp. Guodian opened an office last week in Bishkek, the Kyrgyz capital, and said it was pursuing electricity generation projects including hydropower. Guodian is still scheduled to issue 1 billion Yuan in corporate bonds on April 13.

It will be interesting to see how the situation in Kyrgyzstan unfolds. Watch closely and you might catch the interaction of clandestine operations, "legitimate" warfare, psyops, American, EU, Russian, Chinese, and multinational interests of all stripes collide!

At issue is transport and supply of the so-called Af-Pak theater and the larger contest for the resources and markets of the one of the world's least developed regions. As with Vietnam the USA is opting to destabilize a border region of China where Beijing wants to gain the upper hand. We know how that ended. Beijing is just as content to watch patiently as America bleeds on a different Chinese border....

Labels: foreign relations, great power, human rights, new world order, war

April 06, 2010

Boao Forum 2010 Signals Alternative Energy Push

The Boao Forum for Asia begins this week and lasts through the weekend at a luxury hotel on the coast of tropical Hainan Island. The annual gathering of business and political elites is often called the "Chinese Davos" which is odd since there is already a Chinese meeting of the World Economic Forum called the Annual Meeting of the New Champions held the past 3 years in Dalian or Tianjin.

This year's Boao focuses on "Green Recovery" with confabs on sustainability, low carbon objectives, all clues to where investment focus is going. Former US Treasury Secretary Hank Paulson will be on a capital markets panel. There will be discussions on protectionism, consumption in Asia, hot real estate prices with SOHO Chairman Pan Shiyi, China-India Cooperation, the China-Taiwan Economic Cooperation Framework Agreement, and "unleashing the power of the private sector."

Chinese Vice President Xi Jinping will deliver a keynote address and be joined by current politicos Robert Hormats, US Under Secretary of State, Singapore Senior Minister Goh Chok Tong, the Prime Minister of Denmark, Taiwan government officials, and many others.

Business leaders include executives from many American firms including PepsiCo, Harbinger Capital, Goldman Sachs, Bristol-Myers Squibb, Bank of America and Merrill Lynch, Morgan Stanley (of course), the Chicago Board Options Exchange, Nielsen, Prudential, and so on. The activities of the Boao Forum challenges the line of mainstream media that China is "closing for business...."

Labels: alternative energy, foreign investment, foreign relations, morgan stanley, reunification, taiwan

April 05, 2010

Chinese Offshore Wind Farm Shows Benefits of Cooperation & Trade

Labels: alternative energy, clean tech, foreign trade, free trade, tech stocks, technology

April 01, 2010

Sinomania! on assignment - Open Thread

Sinomania! will be on assignment until next week. Use this post as an open thread. Treasury must report to Congress on Chinese currency in mid month. Will the Obama administration appease scared politicians up for re-election with a Chinese bogeyman and unleash a trade war?

[UPDATE: Camp Obama Punts - the Treasury Dept. said its semiannual statement on currencies will be delayed until after the G20 summit in June. When the USA put pressure on China at the Copenhagen Summit it nearly derailed the entire event. At last year's G20 in London China showed it is impervious to pressure even from her so-called peers. Good luck Geithner.]

Labels: currencies, news

CHINA TO SELL US TREASURIES FOR GOLD

In a surprise move Beijing's State Council will soon announce that China will redeem nearly all its holdings of US Treasury securities and demand compensation for their current market value in gold. Official notification is expected in advance of the US Treasury Department's anticipated ruling that Beijing is manipulating Renminbi and will be delivered in private direct to Treasury Secretary Geithner before the close of business April 1. Through an obscure legal ruling from the days of FDR China will demand payment for its holdings of US treasuries in gold and at just under $900 billion Beijing will take possession of a large part of Fort Knox. An unnamed source at the White House said all efforts would be made to discreetly move the gold from Fort Knox in order to avoid anti federal government sympathies....

[Ed. note: this is a special April Fool's Day report.]

Labels: news

Subscribe to Comments [Atom]