April 30, 2009

Ma's Efforts Bear Fruit

The Taiwan stockmarket rose over 6% on the news of the

biggest ever China-Taiwan business deal: China Mobile will buy a 12% stake in Far EasTone Telecommunications, Taiwan's third largest telecom firm in a deal worth over half a billion (US) dollars. The news accompanied the decision (allowed by Beijing) for Taiwan to participate in the WHO governance body meeting opening the door to Taipei's decade long quest to join the UN organization. Analysts at Goldman Sachs are so buoyed by the progress of Taiwan's slow but inexorable peaceful reunification with the motherland that they added an extra percentage to their growth forecast's for the Taiwan economy this year....

Labels: reunification, taiwan, Telcom, un

# posted by Sinomania! : 4/30/2009 11:47:00 AM

0 Comments

April 29, 2009

China-Japan Bilateral Talks Urge Currency Swaps

Labels: currencies, foreign exchange, foreign trade, japan

# posted by Sinomania! : 4/29/2009 02:17:00 PM

0 Comments

April 28, 2009

Chittagong China Rail Link

The rail link would close a gap in the long sought after UNESCAP "Trans-Asian Railway" project and cross one of the most remote and undeveloped regions of the world.

Chittagong is Bangladesh's chief seaport and main center for industrial development being the location of the country's only steel plant and oil refinery. Chittagong is well poised for container handling development and has deep water channel and large frontage for container ships. Chinese companies have been active in developing the port facilities at Chittagong for several years. Chittagong is identified by war strategists as one of China's "String of Pearls" - potential navy bases and connected ports to loosen the grip on Chinese trade flows through the Straits of Malacca...

Labels: burma, navy, strategic

# posted by Sinomania! : 4/28/2009 09:56:00 AM

2 Comments

April 27, 2009

Geely Sizes Up SAAB

A Swedish business newspaper reports that execs from privately-held Chinese automaker

Geely spent an entire day sizing up SAAB. Geely is known to be interested in a possible purchase of SAAB from troubled owner GM...

Labels: chinese autos, free trade, gm

# posted by Sinomania! : 4/27/2009 01:45:00 PM

0 Comments

April 24, 2009

CHINA INCREASES GOLD RESERVES

After weeks of speculation, it's official:

China gold reserves increased and China now holds more gold than Switzerland. The US, Germany, France, and Italy still hold far more gold but the acknowledgement by the head of the aptly named SAFE (State Administration of Foreign Exchange) lead many to believe that Beijing may soon buy gold. The last reported figure for China's gold reserves was in December 2002 at approximately 600 tons. The new figure is 1,054 tons of gold and Beijing says the increase came from domestic sources. China is the leading gold producer in the world and could easily increase its gold reserves from its own mines. The planned sale of IMF gold however could proved tempting.

Labels: currencies, forex, gold

# posted by Sinomania! : 4/24/2009 02:19:00 PM

0 Comments

ReUnification Watch: China-Taiwan Talks to Expand Banking, Air Transport Ties

This weekend in Nanjing officials from the Beijing and Taipei governments will meet to negotiate greater economic ties. Taiwan wants approval to do banking business on the mainland and increase air routes. China wants to invest in Taiwan real estate and services. While outside observers don't expect rapid changes the talks are further evidence of the slow but inevitable economic absorption of Taiwan island into the Chinese motherland similar to the period 1980-84-1997 before the Hong Kong handover...

Labels: reunification, taiwan

# posted by Sinomania! : 4/24/2009 12:15:00 PM

0 Comments

April 23, 2009

China SWF Refines Its Mission, Looks to Europe

Labels: financial news, global economy, swf

# posted by Sinomania! : 4/23/2009 10:15:00 AM

0 Comments

April 22, 2009

GM to Shut US Production, Build 8th Factory in China

Labels: chinese autos, gm

# posted by Sinomania! : 4/22/2009 03:41:00 PM

0 Comments

Taming the Dragon

Labels: alternative energy, yangtze

# posted by Sinomania! : 4/22/2009 11:29:00 AM

0 Comments

April 21, 2009

CHINA BUSINESS NEWS FOR APRIL 21, 2009

Here are the leading business and finance stories pushed by Xinhua for 04/21/09:

*China says nationwide drive improves food safety monitoring

BEIJING, April 21 (Xinhua) -- China said Tuesday that food safety monitoring had improved since it launched a nationwide drive in December against illegal additives.

*China, Russia sign oil cooperation agreement

BEIJING, April 21 (Xinhua) -- China and Russia officials signed an oil cooperation agreement here Tuesday, which Chinese Vice Premier Wang Qishan described as a major breakthrough in bilateral energy cooperation.

*Crisis won't affect Airbus China assembly target: official

TIANJIN, April 21 (Xinhua) -- Leading world aircraft producer Airbus will cut monthly global production of the A320 in October but its assembly target in China won't change, a senior company official said Tuesday.

*China's insurance premiums expand 10 pct in 1Q, regulator reports

BEIJING, April 21 (Xinhua) -- Insurance premiums paid in China rose 10 percent in the first quarter from a year earlier, to 327.67 billion yuan (47.96 billion U.S.dollars), the China Insurance Regulatory Commission (CIRC) said Tuesday.

*Chinese enterprises are 70 percent private: official

FUZHOU, April 21 (Xinhua) -- More than 70 percent of Chinese enterprises are now privately-owned, said Zhong Youping, vice minister of the State Administration for Industry and Commerce of China here Monday.

*China to launch sixth remote-sensing satellite

TAIYUAN, April 21 (Xinhua) -- China is scheduled to launch a new remote-sensing satellite into the space Wednesday, a spokesman with the Taiyuan Satellite Launch Center in north Shanxi Province said Tuesday.

*China won't copy U.S. and EU in bioenergy development: legislator

CHONGQING, April 21 (Xinhua) -- Rigid domestic demand for grain crops has forced China to turn its back on corn and rapeseed, the traditional raw materials used by the West for bioenergy production, and focus on crops whose annual output stands much higher, said an agricultural legislator Monday.

*Overseas investors in China moving west amid financial crisis

XI'AN, April 21 (Xinhua) -- A Hong Kong-based energy firm has located its regional headquarters in the ancient Chinese capital of Xi'an, one of the latest overseas companies to seek opportunities in western China amid the global financial crisis.

Labels: business news, financial news

# posted by Sinomania! : 4/21/2009 09:40:00 AM

0 Comments

April 20, 2009

Shanghai Auto Show Now Preferred Car Showroom

German and Japanese carmakers vie for attention at this year's Shanghai Auto Show showcasing new Daimler, Porsche, BMW and Toyota cars and concepts at the premier event of the most important auto market in the world today, China. Not to be left out GM is promising sales of the Chevy Volt (perhaps built someday in China?) in 2011 right after its release in the USA. And Ford will move its Asia-Pacific headquarters away from troubled Thailand to China this year. Daimler is skipping the Tokyo auto show altogether. China is the new hot market for cars, particularly luxury brands...

Labels: chinese autos, gm

# posted by Sinomania! : 4/20/2009 04:22:00 PM

0 Comments

Return of the Big Chinese IPO

Labels: chinese stocks

# posted by Sinomania! : 4/20/2009 04:15:00 PM

0 Comments

April 17, 2009

2009 Bo'ao Forum Underway

The

2009 session of the Bo'ao Forum, the all Asia World Economic Forum-style event is underway at the

Bo'ao resort on Hainan Island. Chinese PM Wen Jiabao will give the keynote speech. In the photo, Wen meets with Myanmar (Burma) PM Thein Sein. Chinese and Taiwan ministers and businessmen use the forum to meet and establish links. Delegates include dozens of private and government executives from around Asia and former US President George W Bush...

Labels: global economy

# posted by Sinomania! : 4/17/2009 03:15:00 PM

0 Comments

Oil Up on Chinese Demand

Labels: oil, peak oil

# posted by Sinomania! : 4/17/2009 12:12:00 PM

0 Comments

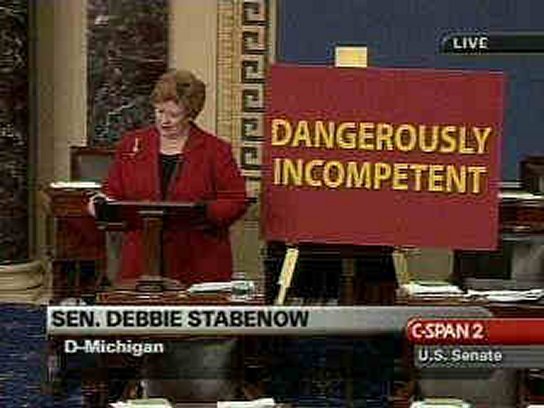

Fundamental Misalignment Redux

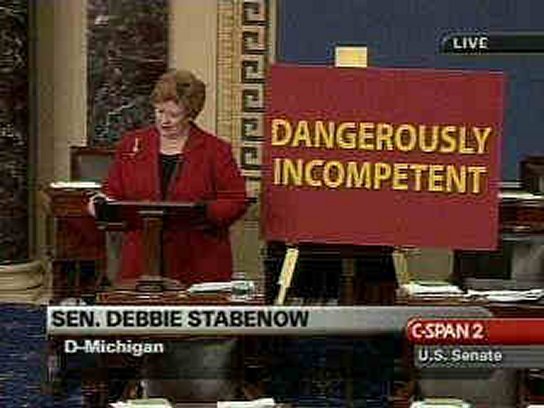

As if it wasn't enough of a burden for US taxpayers to hand over billion$ to dying automakers,

Michigan Senator Debbie Stabenow (Democrat) wants all Americans to pay more - far more - for nearly every item they buy. Stabenow is the latest politican to carry water for the anti-China trade pressure groups and will introduce legislation to accuse China of manipulating its currency for trade advantage and slap big countervailing tariffs and anti-dumping duties on Chinese imports. We've been down this road before...

Labels: currencies, free trade

# posted by Sinomania! : 4/17/2009 12:05:00 PM

0 Comments

April 16, 2009

Is China Hoarding Copper?

Lots of

speculation in the news about moves by the State Reserve Bureau in Beijing to buy huge amounts of primary metals, particularly copper but also aluminum and cobalt. Is China planning a copper standard to back the Yuan? Is Beijing stockpiling industrial resources while the global economy is down in order to be ready for the next boom cycle? Or is China really still chugging along at full speed (compared to sluggish Western economies) despite the impact of the Panic of '08?....

Labels: currencies, foreign exchange, forex, renminbi, yuan

# posted by Sinomania! : 4/16/2009 04:10:00 PM

0 Comments

China to Promote Hemp Cultivation

The green light has been given to

establish hemp cultivation areas in Yunnan, Heilongjiang, Gansu and Anhui provinces as well as the autonomous regions of Xinjiang and Inner Mongolia with the goal of creating a new resource for textiles and paper and bringing millions out of poverty by 2020. Already production is begun in remote district of Yunnan province.

Hemp originated in China. Archeological evidence dating back 9,000 years shows it was a cultivated plant. The psychoactive component THC appears to have occured through experimentation with the plant sometime around 3,000 years ago when varieties yielding marijuana were achieved. Although classified a controlled substance by Beijing, as visitors to China know, marijuana use is widespread and not agressively criminalized as in the USA.

But the hemp cultivation envisioned in the new programs is not marijuana but a Chinese hemp variety called Yunma I and Yunma II developed over the past 20 years to yield even stronger fibers but very low THC content....

Labels: clean tech, economy, land reform

# posted by Sinomania! : 4/16/2009 11:37:00 AM

0 Comments

April 15, 2009

Gwadar Port's Troubled Waters

Beijing's seven year effort to develop a deep water port and eventually connect land, rail, and pipeline routes back to China through landlocked central Asia appears in jeopardy.

Recent events including the murder of three Balochistan political figures -- completely ignored by mainstream media more interested in the Obama family's dog and hero worship of a bumbling American merchant ship captain -- reveal a

tug of war of 'great game' proportions between Karachi, the USA, China, India, and probably Iran over the future of Gwadar Port.

Prior to Richard Holbrooke's unsuccessful visit to Pakistan last week, talk in the region was of an "

Obama Plan" that might allow the competing interests to divvy up the potential of Balochistan as follows:

"Let Pakistan declare the Gwadar Sea Port as an international open port; Let

both the USA and China jointly invest into developing the Gwadar Port as a Deep

Sea Port of international standards; Let the USA build a land route and oil/gas

pipelines from the Gwadar Deep Sea Port to the Commonwealth of Independent

States (CIS) of Central Asia through Afghanistan; Let China construct a land

route and railways (if feasible) from the Gwadar Deep Sea Port to its Khunjerab

Pass and onward through Balochistan, NWFP and Northern Areas; Let India

construct a motorway from New Delhi to Lahore and then Pakistan constructs a

motorway and railways (if feasible) from Peshawar to Jalalabad, city of

Afghanistan, and at the same time, Afghanistan constructs a motorway and

railways (if feasible) from Jalalabad to the American-sponsored land route

extending to the CIS thereby providing India and Pakistan a joint access to

Afghanistan and to the Central Asian States; Let Iran construct a motorway and

railways (if feasible) to the American-sponsored land route in Afghanistan

extending to the central Asian CIS member states thereby providing Iran a land

access to Afghanistan and the Central Asian States, and also to China through

Pakistan or through the CIS; and Let India, Pakistan and Iran jointly build a

gas pipeline from Paras Gas Field of Iran to India through Pakistan for meeting

the growing energy needs of both India and Pakistan"....

Labels: free trade, great power, shipping

# posted by Sinomania! : 4/15/2009 10:53:00 AM

0 Comments

April 14, 2009

China Forex Reserves Near $2 Trillion

Labels: forex, gold

# posted by Sinomania! : 4/14/2009 09:57:00 AM

0 Comments

April 13, 2009

BYD, Buffett, and Electric Cars

Labels: BYD, chinese autos, electric cars, Warren Buffet

# posted by Sinomania! : 4/13/2009 12:09:00 PM

0 Comments

India Re-Imposes Anti-Dumping Duties on Chinese Goods

India continues its overt protectionism against Chinese imports by

re-imposing anti-dumping duties on nylon cord fabric from China. Last year, after Chinese toys accounted for 60% of the market in India, New Delhi banned Chinese toy imports for six months. The global economic decline is putting a strain on the promise of India-China trade and collaboration....

Labels: foreign trade, free trade, india

# posted by Sinomania! : 4/13/2009 10:44:00 AM

0 Comments

Chinese Scientists Break Biological Clock

Labels: high-tech

# posted by Sinomania! : 4/13/2009 10:36:00 AM

0 Comments

April 10, 2009

New Index for Shanghai Stocks

Details are sketchy but later this month (April 23), the China Securities Index Company (that's CSI as in the CSI 300 Index) will

debut the SSE Mega-Cap Index to cover the A share heavyweights.

According to China Daily: "The index includes 20 blue-chips with a combined capitalization of 6.16 trillion yuan, accounting for 49 percent of the total market value of Shanghai-based A shares [last] Wednesday"...

Labels: chinese stocks, csi 300

# posted by Sinomania! : 4/10/2009 04:14:00 PM

0 Comments

China Slowdown Slows Down

Some other indicators for China: March 2009 trade balance: Exports $90.3 billion; Imports $71.7 billion; surplus $18.6 billion / Export growth -17.1%; Import growth -25.1% // Jan-Feb 2009 Industrial Output: 3.8% // Jan-Feb 2009 Retail Sales growth: 15.2% // February 2009 Producer Price Index: -4.5% // February 2009 FDI inflows: $5.8 billion...

Labels: economy, foreign trade

# posted by Sinomania! : 4/10/2009 10:12:00 AM

0 Comments

April 09, 2009

USA Steelmakers File AntiDumping Complaint on Chinese Steel Pipe

Labels: foreign trade, free trade, steel

# posted by Sinomania! : 4/09/2009 11:30:00 AM

0 Comments

April 08, 2009

China Anti-Dumping Duties Never Paid?

Labels: chinese trade, free trade

# posted by Sinomania! : 4/08/2009 12:05:00 PM

0 Comments

April 07, 2009

How China Frames the Pentagon's Debate

A Pentagon disinformation campaign is in full swing thanks to Congress at long last hearing the desires of most Americans to not spend $1 trillion each year on every conceivable weapons system for every possible war scenario. In order to ensure the military-industrial complex continue to eat 3/4 of the American pie the Pentagon needs a reliable bogeyman. That's where Iran usually comes in. But the likelyhood that Obama may highlight his Presidency with a "Nixon in China" moment with Teheran means Iran won't do. Enter China.

Labels: cold war 2, pentagon

# posted by Sinomania! : 4/07/2009 02:44:00 PM

0 Comments

When Better Automobiles Are Built China Will Build Them

For many years Buick's official slogan was "when better automobiles are built Buick will build them," reflecting the long tradition of innovation at Buick (1st overhead valve motor, 1st automatic transmission, 1st mass produced V-6 engine, etc.).

China's auto industry suffers from excess capacity in some areas, disorganization, and needs greater consolidation - a goal of current industrial policy and current regulations. At the same time, however, China's auto industry is well poised to mass produce the newest and most innovative cars. It is only a matter of time before China becomes the world's main car exporter to growing markets mostly centered in Latin America, south Asia, and the middle East...

Labels: automobiles, chinese autos, gm

# posted by Sinomania! : 4/07/2009 11:05:00 AM

0 Comments

April 03, 2009

Chinese Manufacturing Up in March

The China Purchasing Managers' Index, a gauge of nationwide manufacturing activity, stood at 52.4 in March, up from 49.0 in February, and well above its lows of 38.8 in November.

The March data mark the first time the indicator has been above 50 since September, a threshold that indicates activity in the manufacturing sector is in an expansionary mode. Source:

MarketWatch...

Labels: economy, panic of 2008

# posted by Sinomania! : 4/03/2009 09:16:00 AM

0 Comments

April 02, 2009

IMF Gold Sales May Give China Chance to Diversify

The G20 summit hopes to pump $1 trillion (US dollars) into the IMF and World Bank. Word is the IMF will be allowed to sell some of its gold reserves to fund initiatives to help the world's poorest over the short term. Speculation by some analysts are that

IMF gold sales will be off-market and outside the West's Gold Agreement and give nations such as China burdened with excess dollar reserves a chance to diversify into gold...

Labels: currencies, gold, panic of 2008

# posted by Sinomania! : 4/02/2009 12:12:00 PM

0 Comments

April 01, 2009

Official USA Statement on Obama-Hu Bilateral Meeting

In its entirety for posterity:

Statement On Bilateral Meeting With President Hu Of China

Office of the Press Secretary, 04.01.09, 10:47 AM EDT

Hu and Obama discuss U.S.-China relations.

On April 1, 2009, President Barack Obama of the U.S. and President Hu Jintao of China met on the sidelines of the G-20 Financial Summit in London. The two heads of state had an extensive exchange of views on U.S.-China relations and global issues of common interest, and reached the following points of agreement:

I. Toward Enhanced U.S.-China Relations

The two sides agreed to work together to build a positive, cooperative and comprehensive U.S.-China relationship for the 21st century and to maintain and strengthen exchanges at all levels. President Hu Jintao invited President Obama to visit China in the second half of this year, and President Obama accepted the invitation with pleasure.

The two sides decided to establish the "U.S.-China Strategic and Economic Dialogue." U.S. Secretary of State Hillary Clinton and Chinese State Councilor Dai Bingguo will chair the "Strategic Track," and U.S. Secretary of the Treasury Timothy Geithner and Chinese Vice Premier Wang Qishan will chair the "Economic Track" of the Dialogue, each as special representatives of their respective presidents. The two sides will hold the first round of the dialogue in Washington, D.C., this summer. The two sides stated that they will continue to advance mutually beneficial cooperation in economics and trade through the mechanism of the high-level Joint Commission on Commerce and Trade.

The two sides agreed to further deepen mutually beneficial cooperation in a wide range of areas, including economy and trade, counterterrorism, law enforcement, science and technology, education, culture and health. They also agreed to resume and expand consultations on non-proliferation and other international security topics. They welcomed further exchanges between the national legislatures, local authorities, academics, young people and other sectors. The two sides agreed to resume the human rights dialogue as soon as possible.

Both sides share a commitment to military-to-military relations and will work for their continued improvement and development. The two sides agreed that Admiral Gary Roughead, U.S Chief of Naval Operations, will visit China upon invitation in April to attend events marking the 60th anniversary of the founding of the Navy of the Chinese People's Liberation Army. The U.S. looks forward to visits by senior Chinese military leaders this year.

The two sides agreed to maintain close communication and coordination and to work together for the settlement of conflicts and reduction of tensions that contribute to global and regional instability, including the denuclearization of the Korean Peninsula, the Iranian nuclear issue, Sudan humanitarian issues and the situation in South Asia.

The two sides agreed to intensify policy dialogue and practical cooperation in energy, the environment and climate change building on the China-U.S. Ten Year Energy and Environment Cooperation Framework, carry out active cooperation in energy efficiency, renewable energy, and clean energy technologies and work with other parties concerned for positive results at the Copenhagen conference.

II. Strengthening Economic and Financial Cooperation

The two presidents discussed challenges facing the global economy and financial system. They pledged that, as two major economies, the U.S. and China will work together, as well as with other countries, to help the world economy return to strong growth and to strengthen the international financial system so a crisis of this magnitude never happens again.

The two presidents welcomed the fiscal stimulus measures taken by the other, and agreed that these measures were already playing a stabilizing role for the global economy. They also agreed that strong financial systems were essential for restoring growth, and they welcomed the commitment of both countries to address issues in this area. President Obama underlined the commitment of the United States to implement the American Recovery and Reinvestment Act and the Financial Stability Plan. He underscored that once recovery is firmly established, the United States will act to cut the U.S. fiscal deficit in half and bring the deficit down to a level that is sustainable. President Hu emphasized China's commitment to strengthen and improve macroeconomic control and expand domestic demand, particularly consumer demand, to ensure sustainable growth, and ensure steady and relatively fast economic development.

The two presidents agreed the international financial institutions should have more resources to help emerging market and developing nations withstand the shortfall in capital, and the two countries will take actions toward this goal. China and the United States agreed to work together to resolutely support global trade and investment flows that benefit all. To that end, they are committed to resist protectionism and ensure sound and stable U.S.-China trade relations.

President Hu and President Obama discussed regulatory and supervisory changes needed to reform and strengthen the global financial system, including regulatory standards. President Hu welcomed the recent U.S. announcement of a comprehensive financial regulatory reform agenda. President Obama welcomed the commitment of China to continue the development and reform of its financial system.

The Presidents agreed on the need for sweeping changes in the governance structure of international financial institutions.

President Obama underscored that such changes were needed so that these organizations better reflect the growing weight of dynamic emerging market economies in the global system.

President Hu and President Obama concluded that continued close cooperation between the United States and China was critical at this time to maintain the health of the world economy and would remain so in the future. They both recognized that as major economies, the United States and China have a need to work together, as well as with other countries, to promote the smooth functioning of the international financial system and the steady growth of the world economy.

To this end, the two sides will exchange views and intensify coordination and cooperation on global economic and financial issues, climate change and energy, and other important issues through the Strategic and Economic Dialogue that the two countries have decided to establish.

Labels: foreign relations, hu jintao, obama, strategic dialogue

# posted by Sinomania! : 4/01/2009 10:47:00 AM

0 Comments

Atlantic Alliance vs. G3

The most important meetings at the G20 summit in London will be done by the end of the day: the first official face-to-face between President Obama and Russian President Medvedev and Chinese President Hu Jintao and the

private meeting between Obama and Queen Elizabeth II.

Much discussion centers over whether a new G2 is emerging between the USA and China, the forces behind the world's number 1 and 2 "new deals" of government spending. But just as important is the potential that the USA and Russia may reduce their nuclear stockpiles perhaps someday down to a mere 1,000 armed missiles apiece. While China's nuclear capacity is a deterrant (to invasion and/or attack) only such a development would in effect create a tripolar world between USA, Russia, and China.

The one bit of substance from Obama and Hu meeting is the tweaking of the US-China Strategic Economic Dialogue - the word "and" is now added between Strategic and Economic enlarging the focus to matters of State (Sec. State Clinton) and Treasury (Sec. Geithner).

An aside: the hapless crowd of protesters outside the Bank of England with all their competing slogans, costumes, and aims recalls Chairman Mao's observation before the Paris Riots in the 60's that there will be no capitalist crisis great enough in the future to bring the middle classes into the streets for a 20% rise in wages as the bourgeoisie had co-opted itself to the ruling class. Were this really the "greatest financial crisis since the Great Depression" or the true Crisis of Capitalism predicted by Marx the protesters in London would not leave the streets. Odds are they will all be back in their flats by nightfall...

Labels: g3, hu jintao, obama

# posted by Sinomania! : 4/01/2009 09:09:00 AM

0 Comments

Subscribe to Posts [Atom]

Beijing's seven year effort to develop a deep water port and eventually connect land, rail, and pipeline routes back to China through landlocked central Asia appears in jeopardy.

Beijing's seven year effort to develop a deep water port and eventually connect land, rail, and pipeline routes back to China through landlocked central Asia appears in jeopardy.